| Q2 • 2021 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

The past year threw a number of curveballs at the real estate industry. While we are still living in unpredictable times, just about every economist is pointing to an economy set to explode in 2021. With lockdown restrictions easing and cities reopening across the Pacific Northwest thanks to the rollout of vaccines, apartment demand is expected to see a substantial rise this year. Vacancy rates should fall back, and strong prospects for NOI growth mean yields will either edge back or hold steady this year. Read below for specific submarket snapshots.

Oregon: Oregon’s Eviction Moratorium ended on June 30, 2021. Regular rent payments resume on July 1, 2021, unless tenants can show documentation that they have applied for rental assistance. Proof of incoming rental assistance may award tenants 60 days before eviction action can be taken on a current non-payment balance. Additionally, in May 2021, a bill passed in Oregon extending the grace period for repayment of rent balances to February 28, 2022.

Washington: Washington’s Eviction Moratorium ended on June 30, 2021. In June 2021, Washington announced a “bridge” proclamation between the eviction moratorium and the housing stability programs, effective July 1, 2021 through September 30, 2021. Beginning August 1, 2021, renters are expected to pay full rent, reduced rent negotiated with landlord, or actively seek rental assistance funding. Landlords may only evict a tenant if none of those actions are being taken, but must offer the tenant a reasonable re-payment plan before beginning the eviction process.

This Multifamily Market Pulse brought to you by TMG Multifamily, providing property management services across Washington and Oregon since 1985. The TMG Family of Companies specializes in both multifamily and single family property management, homeowners association management, maintenance, and home repair.

CARMEN VILLARMA

President, CPM

carmen.villarma@tmgnorthwest.com

(360) 606-8201

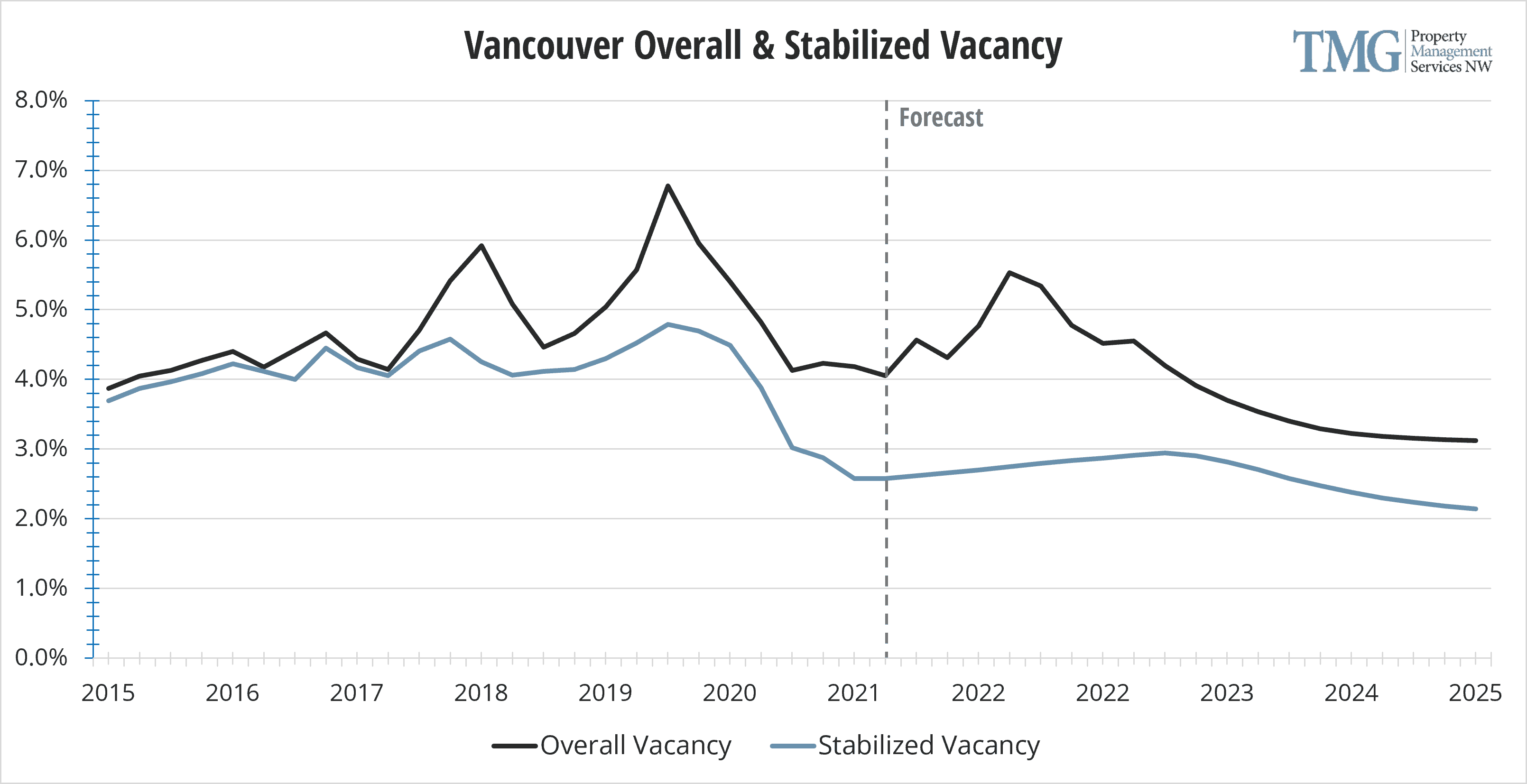

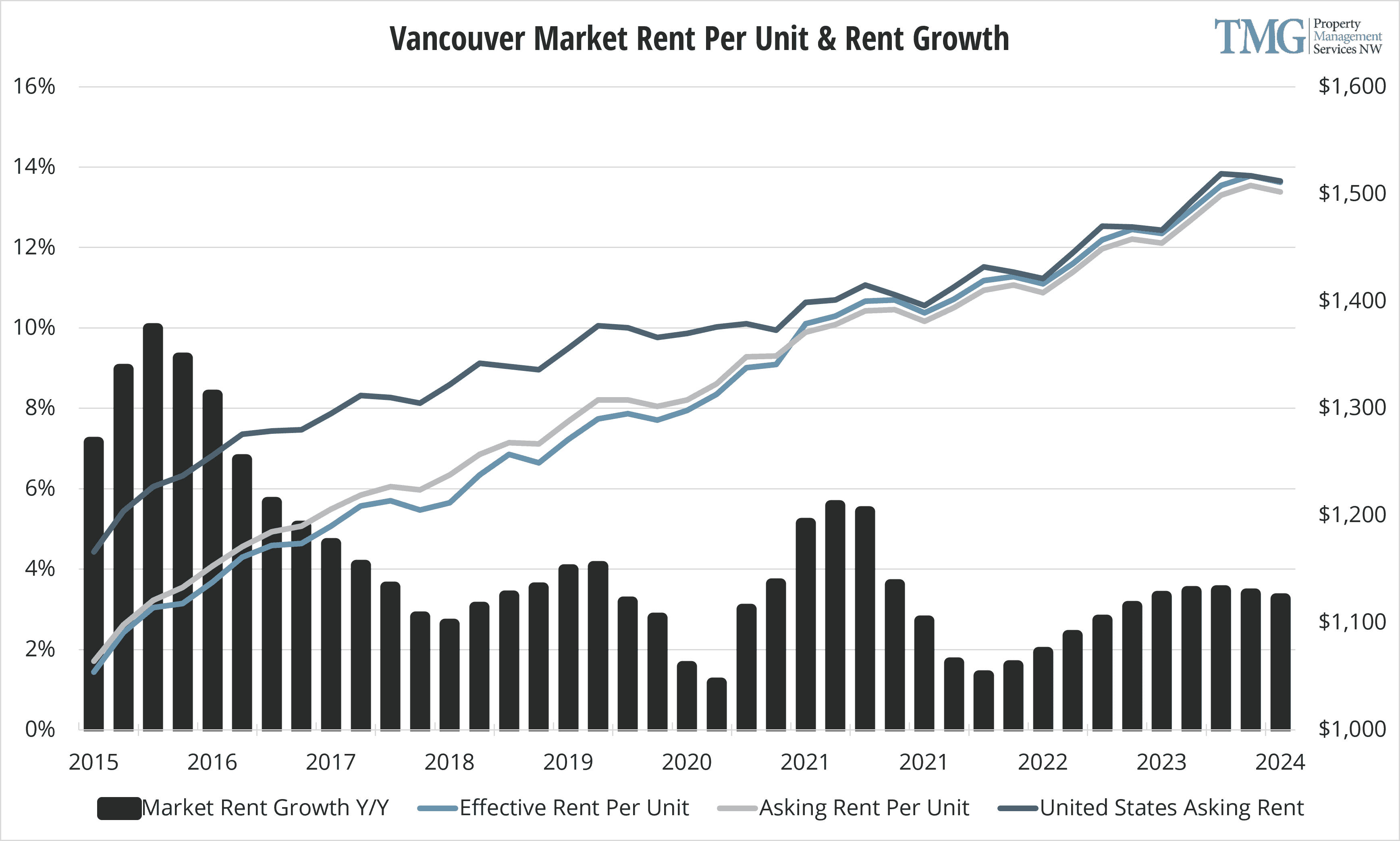

Vancouver/Clark County

7710 NE Vancouver Mall Drive

Vancouver, WA 98662

P. (360) 892-4000

Portland-Metro

15350 SW Sequoia Pkwy, #200

Portland, OR 97224

P. (503) 598-0552

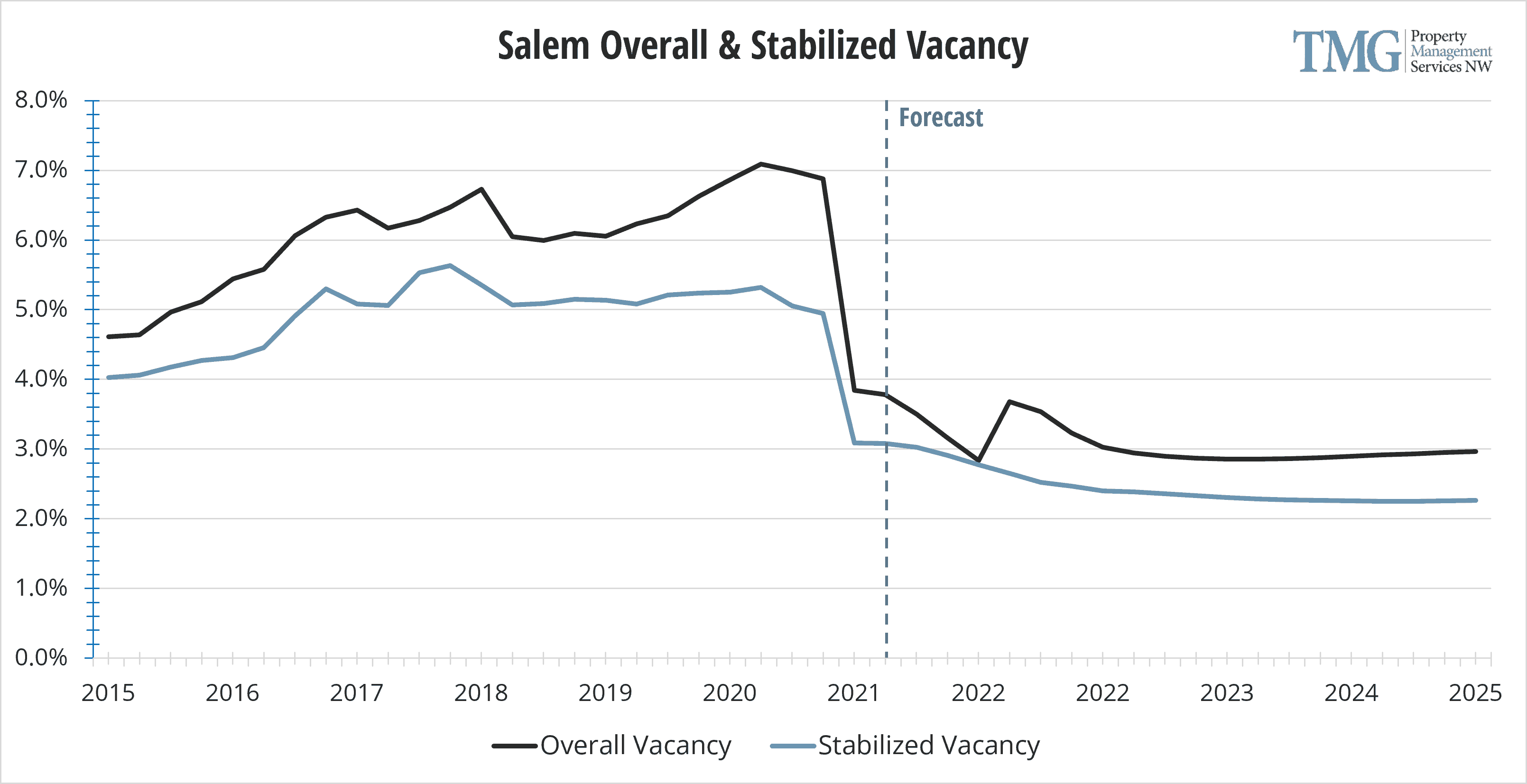

Salem

698 12th Street SE, Ste. 240A

Salem, OR 97301

P. (503) 376-9481

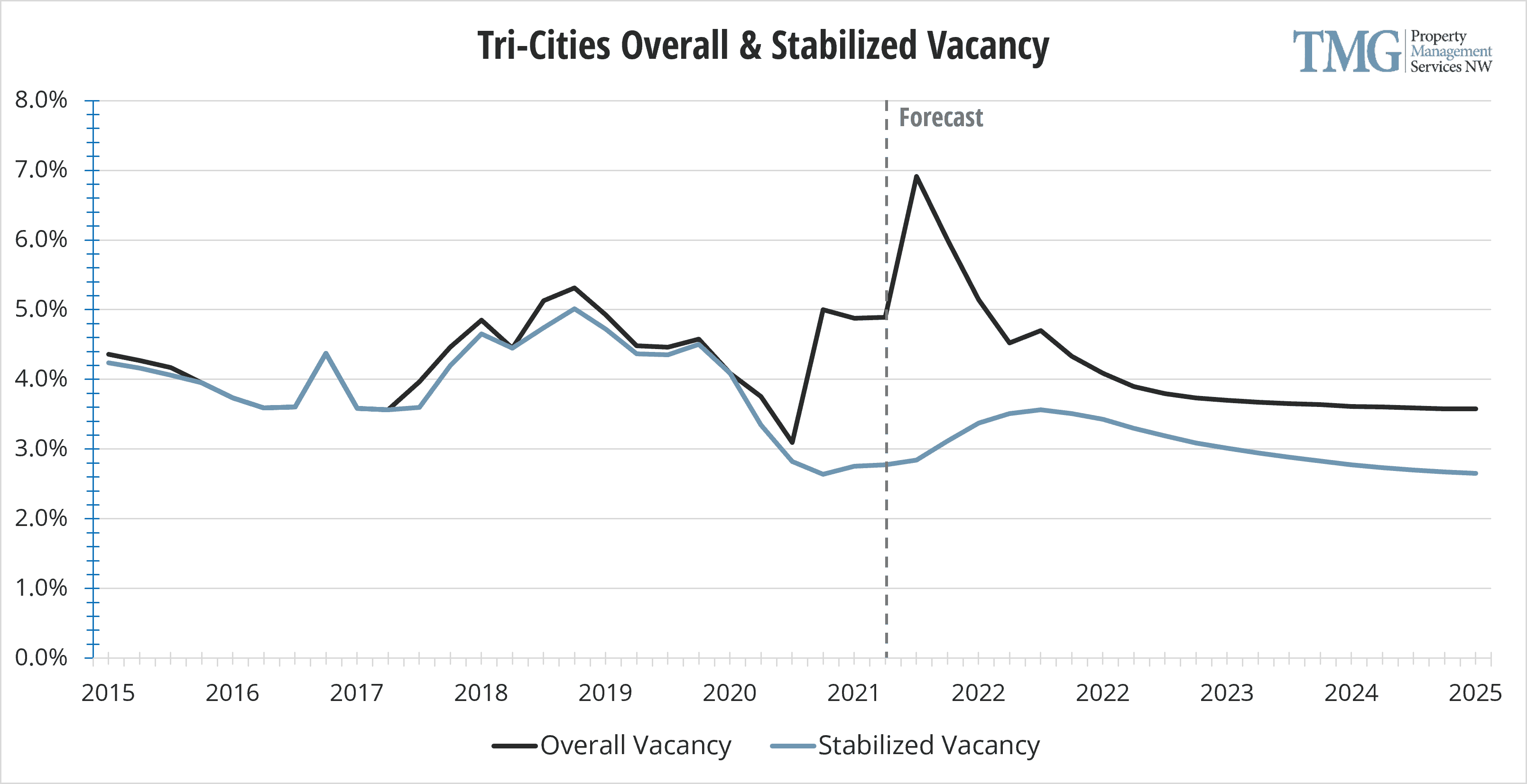

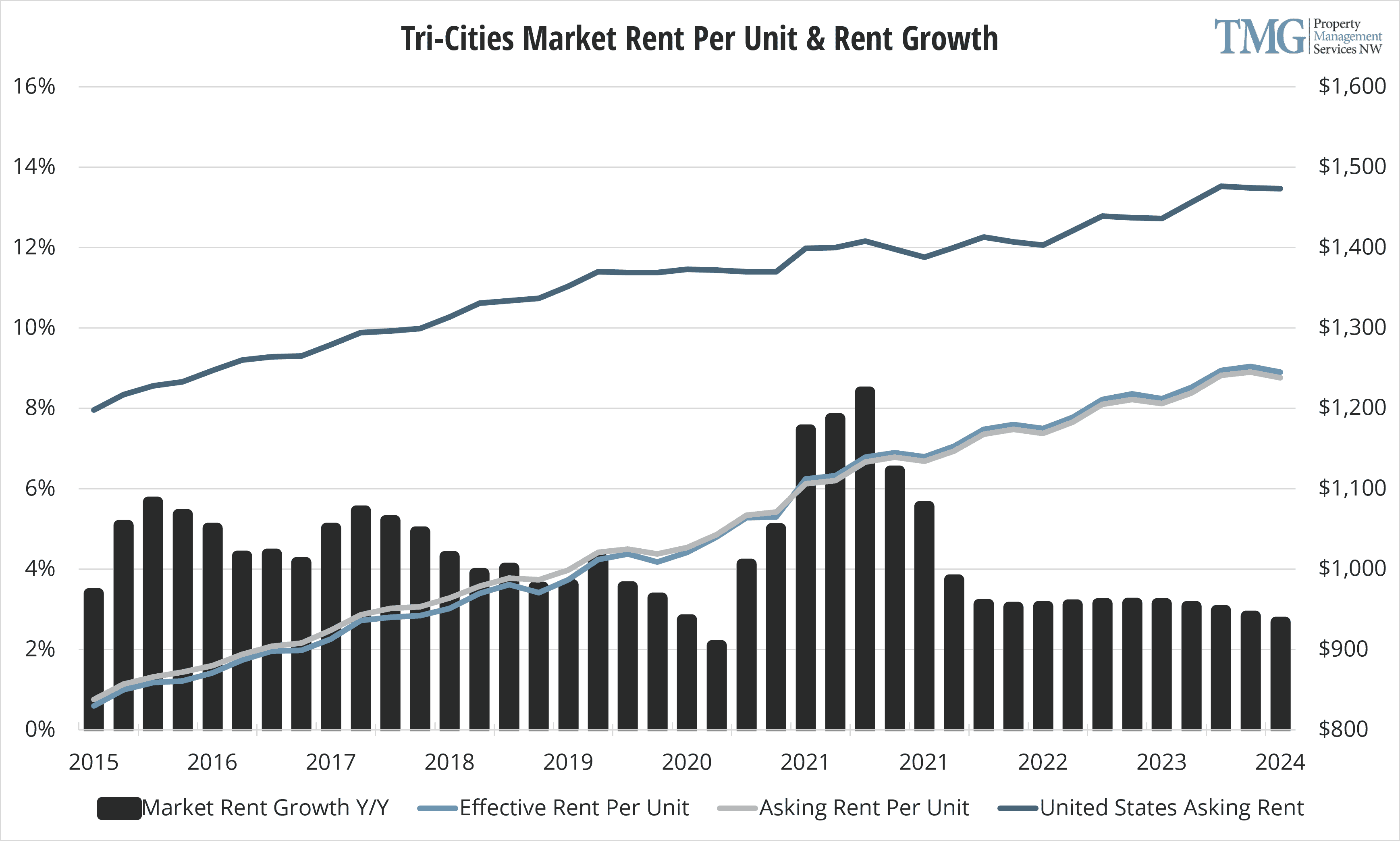

Tri-Cities

30 S Louisiana Street

Kennewick, WA 99336

P. (509) 591-4444

All data in this report is pulled from CoStar