| Q3 • 2022 |

TMGMultifamily

MARKET PULSE

A Snapshot of the Pacific Northwest Multifamily Housing Market

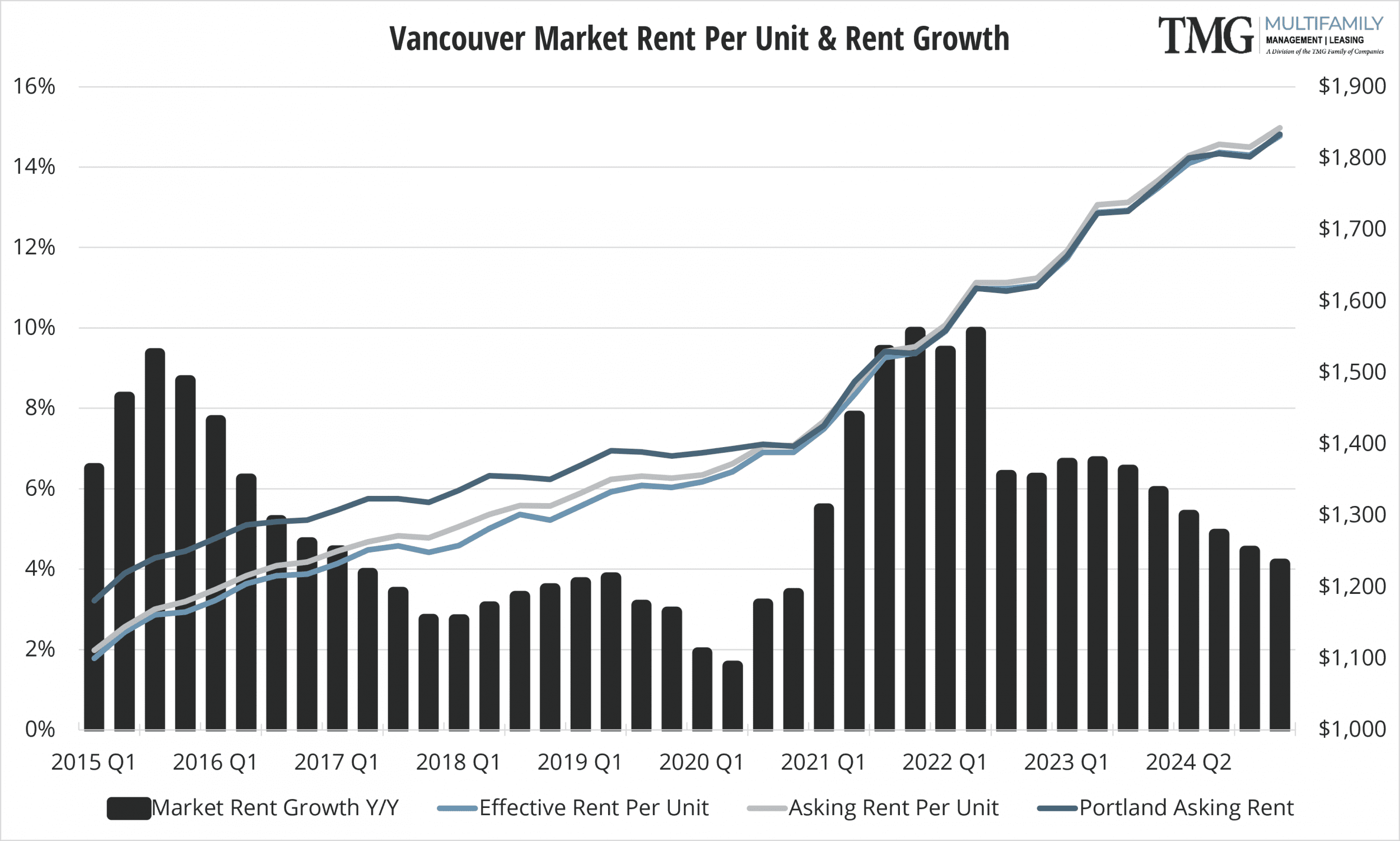

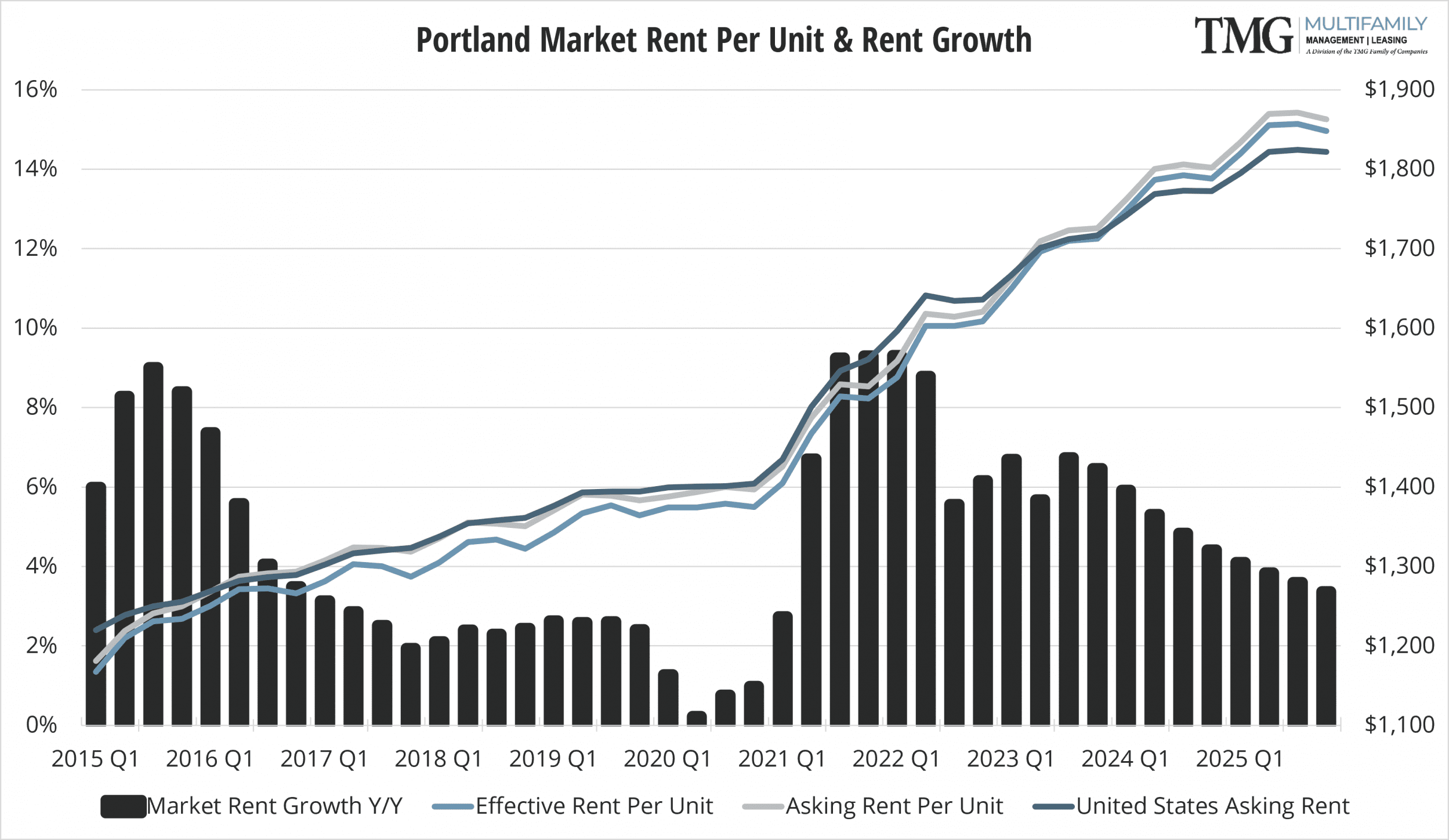

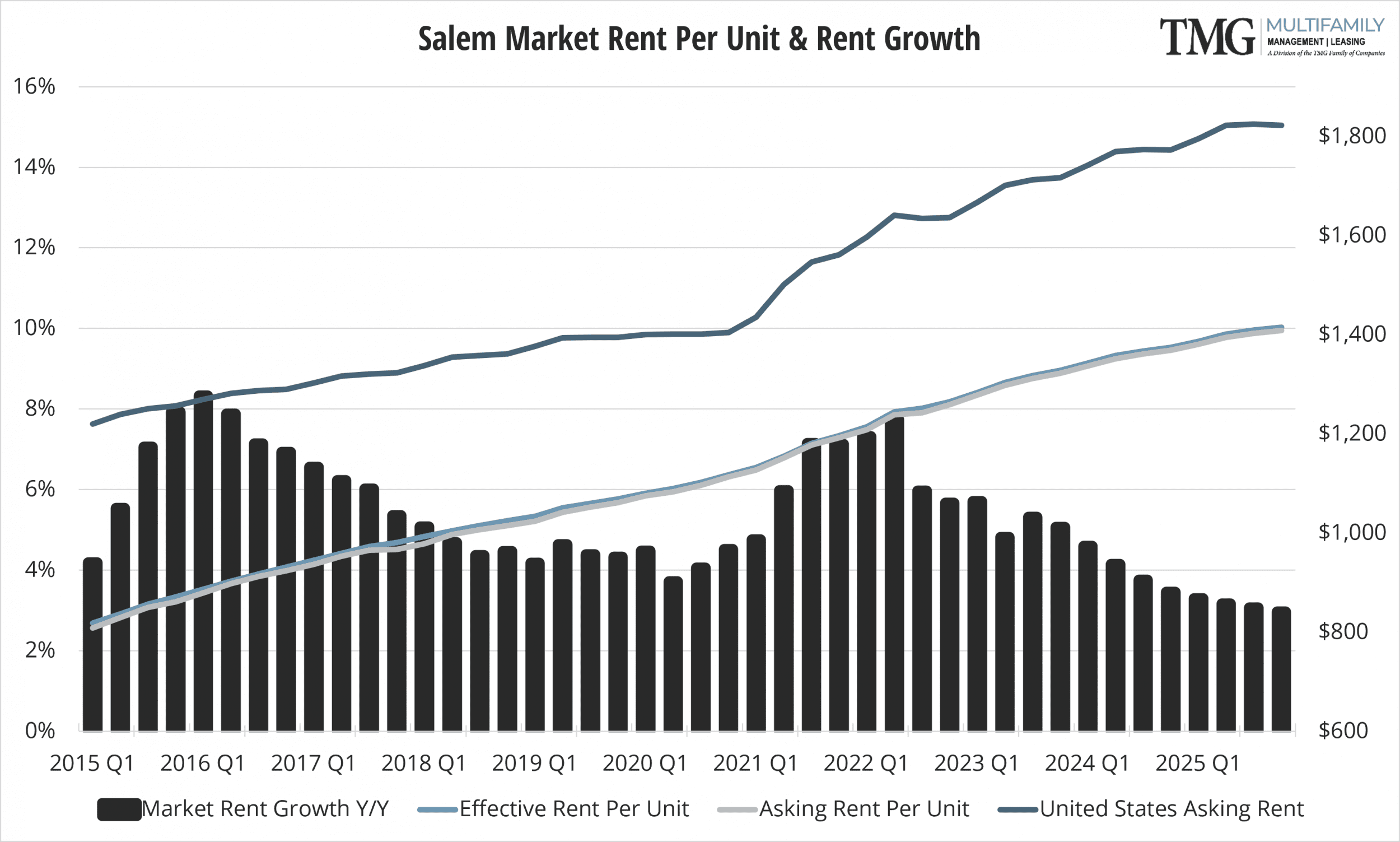

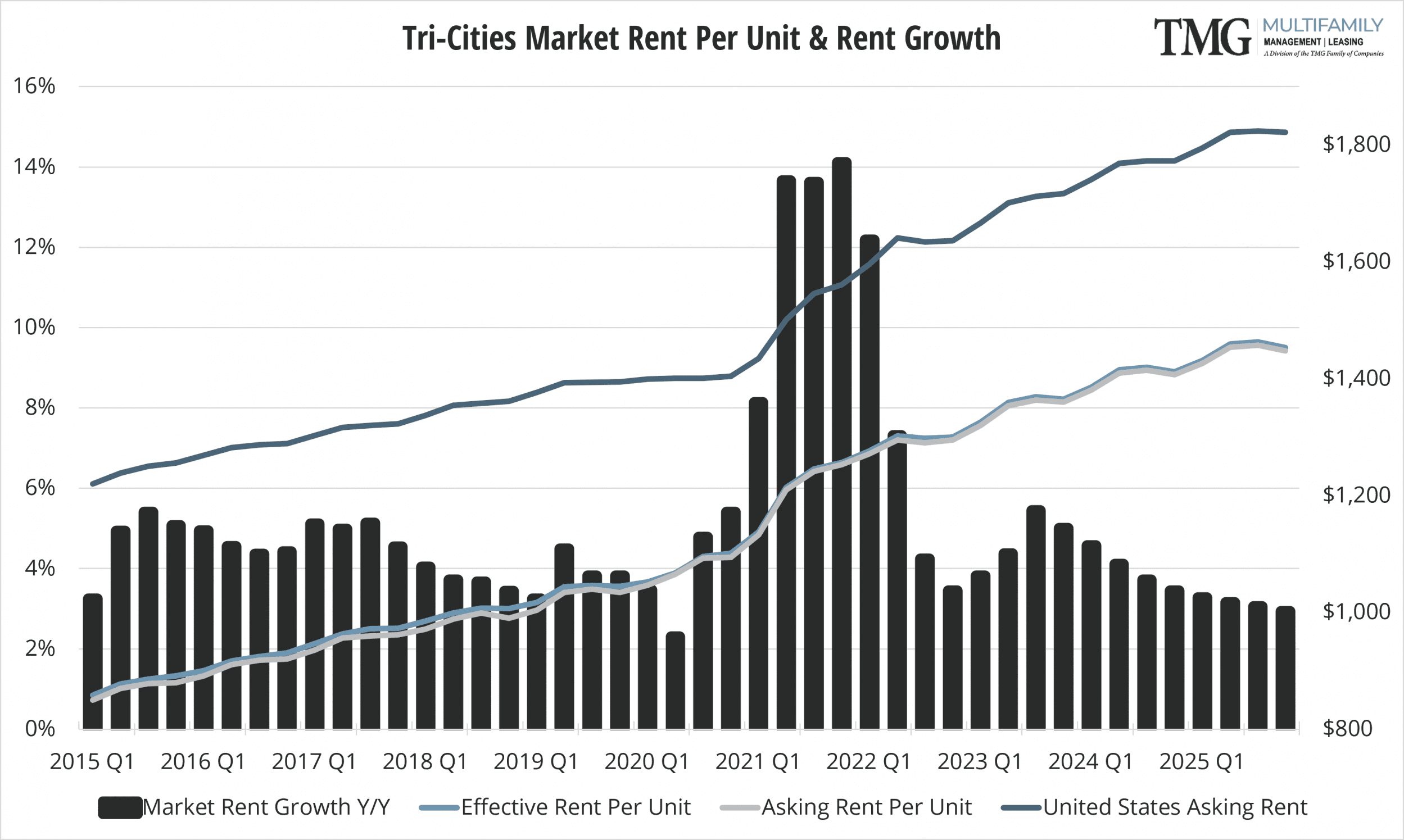

In September 2022, the U.S. rental market experienced single-digit growth for the second month in a row. The median rent growth across the top 50 metros slowed to 7.8% year-over-year. It is the lowest growth rate in 16 months but still more than 2X faster than the growth rate seen just before the pandemic hit in March 2020.

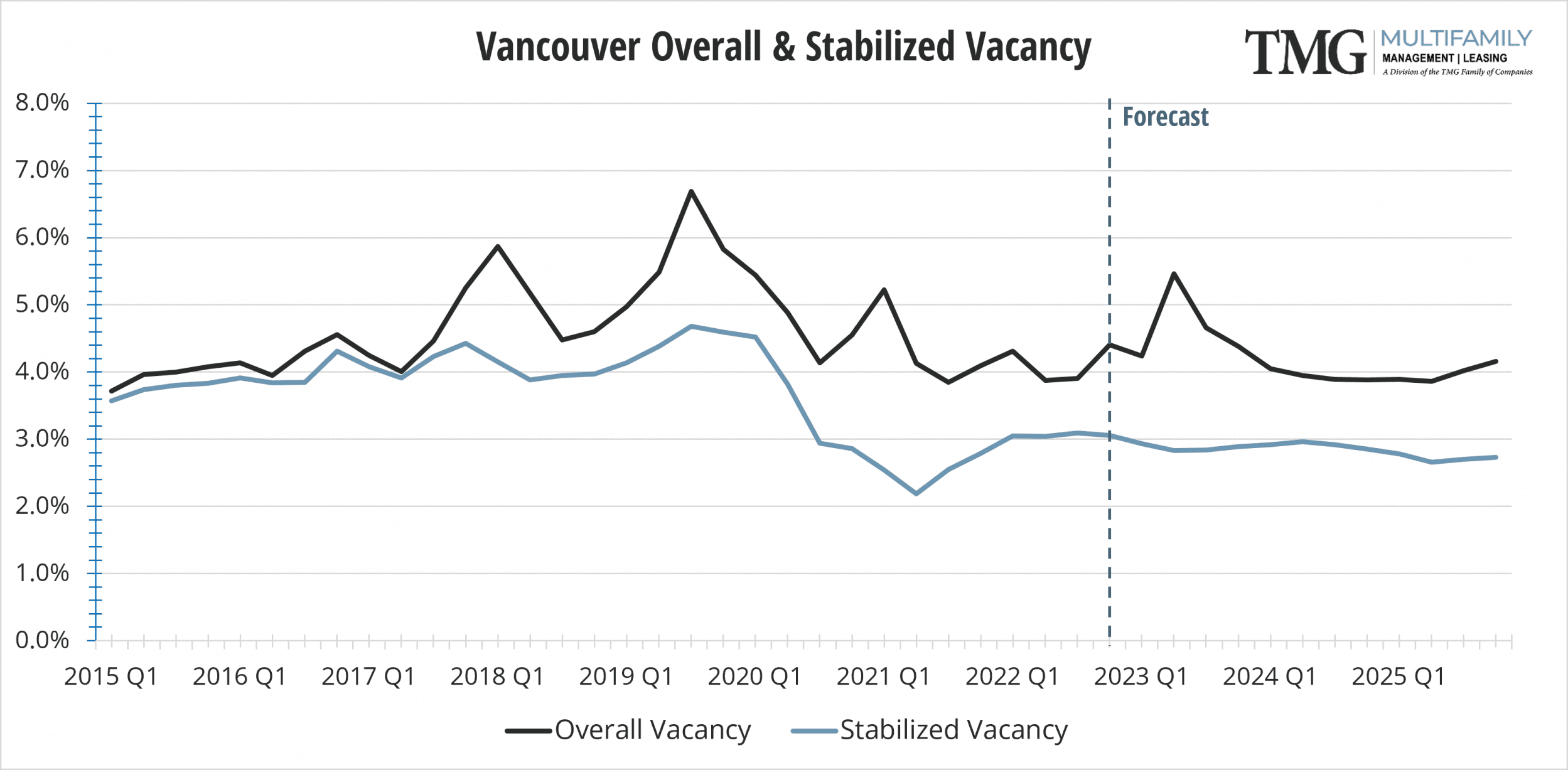

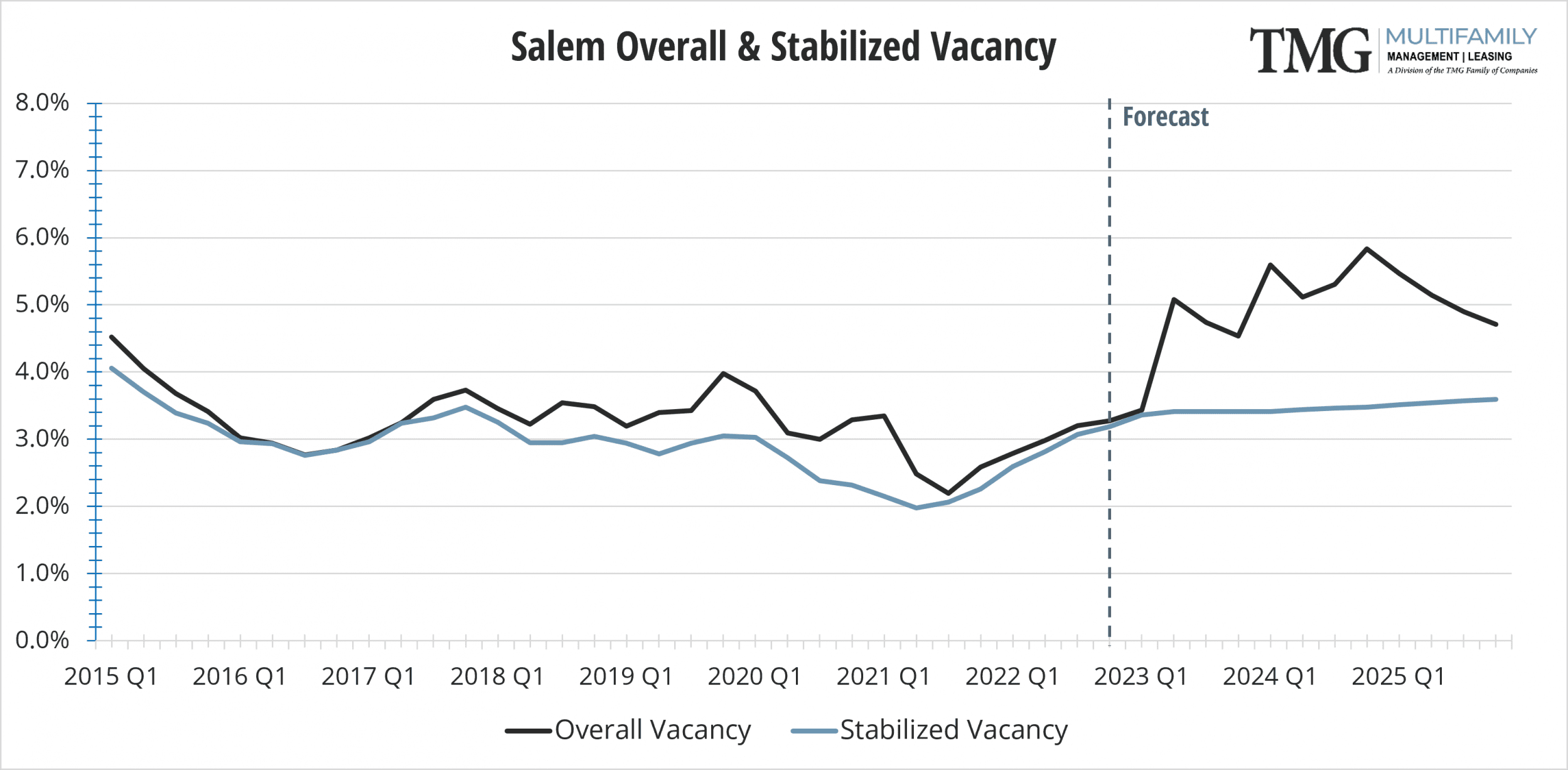

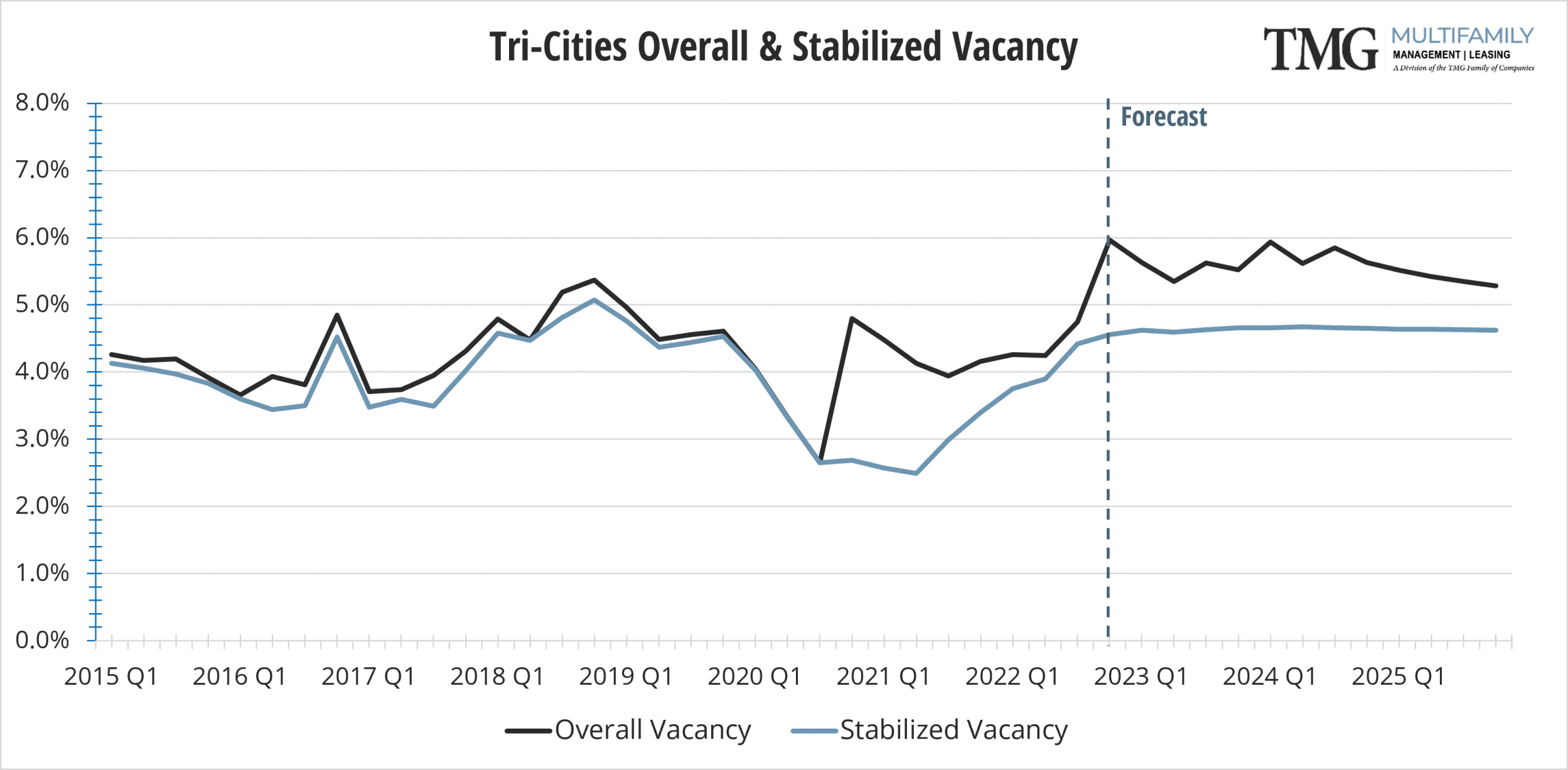

The increase in interest rates is now affecting the demand for rental housing. With fewer renters leaving the rental market for homeownership, vacancy rates continue to remain low, keeping rental price growth elevated but still off the highs of previous months. We are starting to see moderation in asking rents. The in-place rents (tenants currently in a lease) will likely have significant rent increases ahead of them before they catch up to the growth in the asking rents we’ve seen. Inflation is effectively outpacing the wage growth renters have seen over the past 18 months and we may begin to see delinquency rates climb higher in 2023.

Builders are still ramping up multifamily production and the supply of housing in 2023 is predicted to increase, albeit not enough to tip the scales significantly. The increase in interest rates for permanent financing on new apartments in 2023 may necessitate higher rents in order to capture the original return most builders projected early on, just one more reason rent growth will continue.

This Multifamily Market Pulse brought to you by TMG Multifamily, an AMO accredited property management company providing a full suite of management services for existing apartments, new developments, lease-ups, and mixed-use properties. TMG partners with investors to proactively identify strategic opportunities and maximize their return on investment. Locally owned and regionally focused, TMG has been helping clients reach their financial goals for more than 30 years.

CARMEN VILLARMA

President, CPM

carmen.villarma@tmgnorthwest.com

(360) 606-8201

Vancouver/Clark County

7710 NE Vancouver Mall Drive

Vancouver, WA 98662

Portland-Metro

15350 SW Sequoia Pkwy, #200

Portland, OR 97224

Salem

698 12th Street SE, Ste. 240A

Salem, OR 97301

Tri-Cities

30 S Louisiana Street

Kennewick, WA 99336

All data in this report is pulled from CoStar